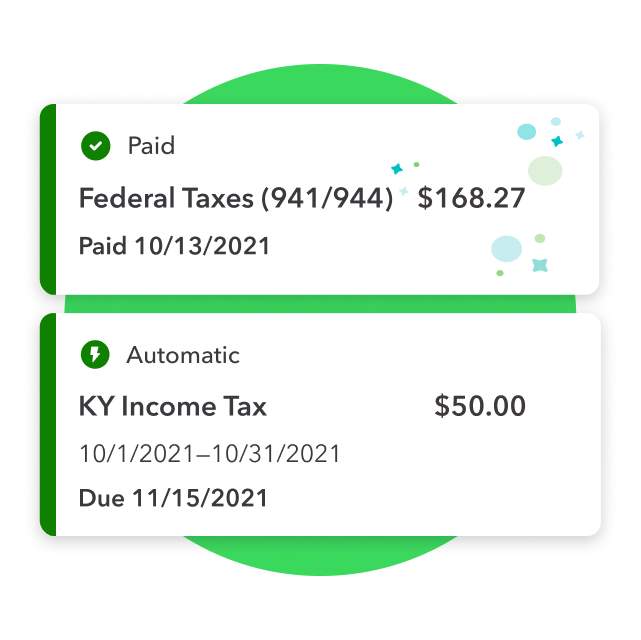

Payroll Taxes In Quickbooks . quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. 38k views 2 years ago. streamline your payroll tax info and make managing your team. when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. It involves setting up federal,. to make a tax payment: In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. Go to taxes and select payroll tax (take me there). all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. 4.5/5 (93k)

from quickbooks.intuit.com

38k views 2 years ago. quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. 4.5/5 (93k) configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. streamline your payroll tax info and make managing your team. It involves setting up federal,. when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. to make a tax payment: Go to taxes and select payroll tax (take me there). In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes.

Trucking Payroll Software & Services QuickBooks Payroll

Payroll Taxes In Quickbooks Go to taxes and select payroll tax (take me there). It involves setting up federal,. 38k views 2 years ago. In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. streamline your payroll tax info and make managing your team. when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. Go to taxes and select payroll tax (take me there). quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. to make a tax payment: configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. 4.5/5 (93k)

From quickbooks-payroll.org

QuickBooks Payroll review Features and More QuickBooks Payroll Payroll Taxes In Quickbooks streamline your payroll tax info and make managing your team. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. Go to taxes and select payroll tax (take me there). quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. 4.5/5 (93k) 38k views 2 years. Payroll Taxes In Quickbooks.

From robots.net

How To Do Payroll With Quickbooks Payroll Taxes In Quickbooks Go to taxes and select payroll tax (take me there). In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. streamline your payroll tax info and make managing your team. It involves setting up federal,. all three quickbooks payroll plans (core, premium,. Payroll Taxes In Quickbooks.

From accountcares.blogspot.com

How to Create or Set up Payroll Taxes in QuickBooks Payroll Taxes In Quickbooks configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. It involves setting up federal,. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate. Payroll Taxes In Quickbooks.

From quickbooks.intuit.com

Manually enter payroll paychecks in QuickBooks Online Payroll Taxes In Quickbooks Go to taxes and select payroll tax (take me there). It involves setting up federal,. quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. streamline your payroll tax info and make managing your team. 38k views. Payroll Taxes In Quickbooks.

From statetaxesnteomo.blogspot.com

State Taxes Quickbooks Payroll State Taxes Payroll Taxes In Quickbooks In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. Go to taxes and select payroll tax (take me there). 38k views 2 years ago. streamline your payroll tax info and make managing your team. quickbooks payroll automatically calculates provincial and federal. Payroll Taxes In Quickbooks.

From pixacre.com

QuickBooks Payroll 3 Things You Need to Know Payroll Taxes In Quickbooks when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. streamline your payroll tax info and make managing your team. configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. In this. Payroll Taxes In Quickbooks.

From quickbooks.intuit.com

How should I enter the previous ADP Payroll into Quickbooks? Payroll Taxes In Quickbooks It involves setting up federal,. Go to taxes and select payroll tax (take me there). streamline your payroll tax info and make managing your team. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. 4.5/5 (93k) to make a tax payment: quickbooks payroll automatically calculates provincial. Payroll Taxes In Quickbooks.

From quickbooks.intuit.com

QuickBooks Core Payroll FullService Payroll Solutions Payroll Taxes In Quickbooks 38k views 2 years ago. It involves setting up federal,. In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. streamline your payroll tax. Payroll Taxes In Quickbooks.

From www.youtube.com

How to set up payroll taxes in the QuickBooks Desktop Payroll setup Payroll Taxes In Quickbooks configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. It involves setting up federal,. to make a tax payment: all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what. Payroll Taxes In Quickbooks.

From fitsmallbusiness.com

How To Set Up & Pay Payroll Tax Payments in QuickBooks Payroll Taxes In Quickbooks streamline your payroll tax info and make managing your team. Go to taxes and select payroll tax (take me there). 4.5/5 (93k) 38k views 2 years ago. when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. configuring payroll taxes in quickbooks is critical for accurate tax. Payroll Taxes In Quickbooks.

From www.youtube.com

How to enter your payroll tax info in QuickBooks Online Payroll YouTube Payroll Taxes In Quickbooks In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. to make a tax payment: configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. Go to taxes and select payroll tax (take me there). quickbooks payroll automatically. Payroll Taxes In Quickbooks.

From quickbooks.intuit.com

Online Payroll Services for Small Businesses QuickBooks Payroll Payroll Taxes In Quickbooks configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. 38k views 2 years ago. It involves setting up federal,. Go to taxes and select payroll tax (take me there). quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. streamline your payroll tax info and make managing your team. In this. Payroll Taxes In Quickbooks.

From www.teachucomp.com

Run a Scheduled Payroll in QuickBooks Online Instructions Payroll Taxes In Quickbooks 4.5/5 (93k) quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. Go to taxes and select payroll tax (take me there). streamline your payroll tax info and make managing your team. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. to make a. Payroll Taxes In Quickbooks.

From www.youtube.com

How to Pay Your Payroll Taxes in Quickbooks Online Payroll YouTube Payroll Taxes In Quickbooks when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. 4.5/5 (93k) quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy. Payroll Taxes In Quickbooks.

From hevodata.com

QuickBooks Payroll Report 4 Critical Aspects Learn Hevo Payroll Taxes In Quickbooks 4.5/5 (93k) It involves setting up federal,. Go to taxes and select payroll tax (take me there). streamline your payroll tax info and make managing your team. all three quickbooks payroll plans (core, premium, and elite) make it easy to calculate and pay these taxes. configuring payroll taxes in quickbooks is critical for accurate tax withholding. Payroll Taxes In Quickbooks.

From kruzeconsulting.com

How do you account for payroll and payroll Taxes in QuickBooks? Payroll Taxes In Quickbooks Go to taxes and select payroll tax (take me there). It involves setting up federal,. to make a tax payment: quickbooks payroll automatically calculates provincial and federal taxes, ensuring accuracy and reducing. configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. 4.5/5 (93k) In this tutorial, we discuss how to set up. Payroll Taxes In Quickbooks.

From qbhelp.me

CommonSense QuickBooks Coaching Submitting Payroll Taxes in QuickBooks Payroll Taxes In Quickbooks configuring payroll taxes in quickbooks is critical for accurate tax withholding and reporting. when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll. 38k views 2 years ago. to make a tax payment: streamline your payroll tax info and make managing your team. quickbooks payroll automatically. Payroll Taxes In Quickbooks.

From fitsmallbusiness.com

How to Set Up, Calculate, & Pay Payroll Taxes in QuickBooks Payroll Taxes In Quickbooks 38k views 2 years ago. In this tutorial, we discuss how to set up payroll tax in quickbooks payroll, followed by how to connect your bank account to easily pay taxes. 4.5/5 (93k) to make a tax payment: when you pay employees, quickbooks calculates taxes, records withholdings and other deductions, and tracks what you’ve withheld as payroll.. Payroll Taxes In Quickbooks.